What is Staking Crypto – A Complete Guide

Staking in crypto involves holding and validating transactions on a blockchain to support its network, earning rewards in return for...

Staking in crypto involves holding and validating transactions on a blockchain to support its network, earning rewards in return for...

If you have been in the crypto space for a while now, you’ll know Ethereum has recently shifted to a proof-of-stake consensus algorithm from its previous proof-of-work one. The upgrade has reportedly cut down on the Ethereum blockchain’s energy usage by 99.95%.

Now, as a newcomer, you might be wondering “what is staking crypto on a proof-of-stake blockchain?”. Well, to put it simply, staking coins is basically locking a part of your crypto funds up on a PoS blockchain for rewards. In this post, we discuss crypto staking in detail, and go through the pros and cons of staking coins!

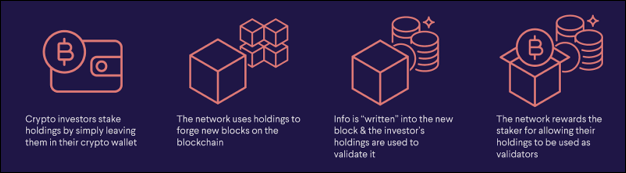

As mentioned before, on a proof-of-stake blockchain, you can lock up a certain amount of the native crypto for a specified period of time to participate in staking. When it comes to validating blocks on the chain, the candidate with the highest stake for the longest period of time is picked each round to act as a ‘validator’. The chosen validator is rewarded for their stake after the successful completion of every round.

Each proof-of-stake protocol requires you to lock up a specified minimum amount of the native crypto to qualify as a staker. Since that’s not exactly affordable to everyone, you can also become a ‘delegator’ for a proof-of-stake chain and offer your share of native coins to a chosen validator.

Proof-of-stake blockchains make validators (nodes from the blockchain network) work in place of intermediaries or payment processors to verify payments on a blockchain. There are staking pools in place where anyone can lock up their crypto funds. Coins like Tezos, Cosmos, and now even ETH allow staking, earning rewards over time to the holders.

The staking pool in which users are staking coins can be compared to an online savings account for better understanding of the process. When you stake your crypto funds, you become a part of the proof-of-stake blockchain of your choosing.

There are multiple ways of staking coins, namely:

Staking solutions like P2P Validator and Stakin provide platforms for multiple contributors to pool their holdings together. By bringing together several stakers, these staking pools bring a better alternative to waiting until you have enough crypto saved up to participate in staking as a validator.

Crypto exchanges that offer staking are an effective solution for newcomers wanting to try their hand at staking. Some of the biggest crypto exchanges like Binance already bring crypto staking services to interested users.

Proof of Stake (PoS) is a consensus mechanism some blockchain networks use as an alternative to Proof of Work (PoW). In a PoS system, instead of miners competing to solve complex mathematical problems to validate transactions and create new blocks, validators are chosen to create new blocks based on the amount of cryptocurrency they hold, or “stake,” in the network.

The more cryptocurrency a node stakes, the more likely they are to be chosen to create a new block and earn a reward as a validator. PoS is more energy-efficient than PoW as it doesn’t require miners to use powerful computers to solve complex problems. PoS can also make the network more decentralized as it doesn’t require much computational power to participate in the network.

Crypto is a highly volatile asset class, and just like every other aspect of the crypto space, crypto staking also comes with its own share of downsides. Risks in staking coins include:

However, despite the risks, the benefits of crypto staking is something that attracts crypto users. Make sure you’re staking only what you can afford to lose, and do careful research before choosing a platform to stake your crypto on.

There are many cryptos that allow the option of staking; users have to choose from them on the basis of their preferred price levels, and also keep the volatility factor in mind. A lot of large crypto holders invest in ETH for staking purposes. While staking independently, you may also choose multiple crypto assets to diversify your reward-earning sources.

The next step is learning the minimum amount of crypto holdings that need to be staked on your chosen blockchain to earn rewards. For example, ETH requires a minimum of 32 ETH to be held at once by a staker, which is a significantly large amount not many contributors can afford.

Every crypto asset has a specific wallet that needs to be used to hold that coin for staking. When you choose to stake a coin, go to the relevant official website and download the software associated with it. Some coins allow other wallets to be used for the staking purpose as well.

Staking coins requires strong hardware support and a stable internet connection. So if you plan on staking crypto assets, choose the best available devices and get a high-speed wifi or Ethernet connection for the same.

Once you have gone through all these basic steps, you can start staking coins on your own terms. Some coins like Tezos also allow automatic staking by holding the coin in wallets like Coinbase.

For exchange-based staking, most of the work is done by the exchange, and users just need to hold the assets in their wallets.

Exchanges like Coinbase and Kraken offer staking services to their users; you can participate in staking by holding certain crypto assets in your wallet. The only thing you have to do is select ‘staking’ as an option on these platforms.

On the other hand, there are some platforms specifically dedicated to staking. They offer ‘staking as a service’ to investors. Staked, MyContainer, and StakeCapital, are some examples of such platforms.

PoS is a consensus mechanism based upon the act of staking, but there are blockchains like Bitcoin running on other consensus algorithms (PoW in Bitcoin’s case) that do not necessitate staking coins.

On a PoW chain, new blocks are added to the blockchain only after a complex mathematical equation is solved by a miner node and data is added to the block. There is no requirement for staking for such blockchains, since miners are in place to validate and add new blocks to the chain.

Therefore, on non-PoS chains, staking is not needed because it is not an integral part of the block validation process.

Crypto staking offers many benefits, namely:

Keep in mind however that with staking, platform fees can change over time, and the market is ever-volatile. So again, stake only the funds you won’t need anytime soon.

Pros of staking coins include:

Some cons to staking crypto would include:

Well, now we have learned the basics of “what is staking crypto?”. It can’t be denied that staking coins has both positives and negatives. Staking can prove to be incredibly beneficial for those who plan on holding certain currencies for a long time and have sufficient funds. However, for newcomers to the crypto space, it’d be a good idea to research thoroughly and consider the risk factors well before entering crypto staking.

There are different risks associated with staking coins; the biggest one is the crypto market’s volatility. Your staked holdings cannot be pulled out as you wish or during a market instability. There’s also the risk of staking pools getting hacked, for investors stand to lose their staked funds in that case.

You may lose crypto through staking in case:

Therefore, it is better to be properly informed about staking coins before going forward with the step.

It is fair to say many investors have earned through staking. Once you have done thorough research and staked the right coins, staking coins can be beneficial.

This is a likely outcome for knowledgeable investors. Some of the long-term investors have already been earning good yield on their staked assets. Do keep in mind though that there are some significant risk factors to consider before participating in staking. The most important factor is DYOR (Do Your Own Research!)

Hard Fork vs Soft Fork | What is Crypto Lending | What is Chainlink | Decentralized vs Centralized Crypto | Zcash Mining | What is Layer 1 Blockchain | TVL Blockchain | How Lisk Works | EVM Virtual Machines and EVM Chains | Solidity Data Types | Slope Wallet Vulnerability | What is a Blockchain Fork | Types of Decentralization in Blockchain | Physical Layer in OSI Model | Cloud Mining Platform | Metaverse Cryptocurrency | Blockchain Features and Benefits | Types of Altcoins | Mobile App Technology Stack | What is Gas in Cryptocurrency