Ethereum Merge: All You Need to Know

Uncover the significance of Ethereum's Merge: transitioning from Proof-of-Work to Proof-of-Stake for enhanced efficiency and sustainability in blockchain...

Uncover the significance of Ethereum's Merge: transitioning from Proof-of-Work to Proof-of-Stake for enhanced efficiency and sustainability in blockchain...

“And we finalized! Happy merge all.” – Vitalik Buterin

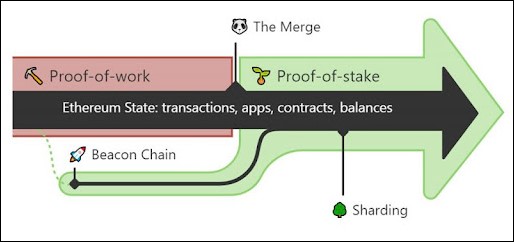

The Merge, the crypto world’s most ambitious software upgrade to date, has been finally done. It has paved the way for changes that would help Ethereum truly transition and become a scalable infrastructure fit for mass-scale adoption. After years of development and delays, the network at the heart of the second-largest cryptocurrency by market value has undergone the transition from Proof-of-Work to Proof-of-Stake via the merging of its execution layer or Mainnet with the Beacon Chain or consensus layer.

Confused as to how this happened? And, what is Ethereum Merge? And are you aware of the Ethereum Merge’s importance? We know you have got questions, and we have got all the answers!

Before we jump into the details of the Ethereum upgrade, it is important to know, ‘what is Ethereum Merge?’ The Ethereum Merge is the union of Ethereum’s Beacon Chain and the Ethereum Mainnet. The Merge represents the transition of the Ethereum blockchain from the previous Proof-of-Work (PoW) consensus protocol to the much more energy-efficient Proof-of-Stake (PoS). The merge will remove the need for energy-intensive mining and allow the network to be secured with staked ETH.

Post The Merge, the stakers will be required instead of miners to validate the transactions and store them on the blockchain. Anyone who has at least 32 ETH to ‘stake,’ or pledges, to the network can become a validator. But even if you do not own 32 ETH, you may take part in the ETH staking via other modes. Staking pools and cryptocurrency exchanges allow users to participate with smaller amounts of ETH. With the Merge finally concluded successfully on September 15, 2022, Ethereum is expected to see the following upgrades:

The public Ethereum production blockchain, where actual-value transactions take place on the distributed ledger, is known as Mainnet. The Proof-of-Work consensus was used for validating transactions and securing the Ethereum Mainnet from its inception until The Merge. The Merge has brought together the current Ethereum Mainnet and the new Ethereum Beacon Chain as one single chain. The Beacon Chain was launched as a separate blockchain from the Ethereum Mainnet on December 1, 2020. The Beacon chain is a self-contained network with a PoS consensus layer. It runs alongside the current Ethereum mainnet.

Initially, the Beacon Chain did not process Mainnet transactions. It was instead reaching an agreement on its own state by agreeing on active validators and their account balances. Following extensive testing, it was time for the Beacon Chain to reach an agreement on real-world data. To put it simply, the Beacon Chain has served as a de facto testnet for Ethereum 2.0.

The Paris upgrade signaled the end of Ethereum Blockchain mining. It also marked the transition from a Proof-of-Work validation system to a Proof-of-Stake validation system. When the execution layer reached the Terminal Total Difficulty (TTD), a Beacon Chain validator generated the next block using PoS. Once the Beacon Chain completed this block, the Merge transition was considered complete.

The Beacon Chain has become the consensus engine for all network data after the Merge. These include the execution layer transactions and account balances. This has significant implications for the network, but the following are critical considerations:

The Ethereum Merge importance is umpteen for the Ethereum network. Blockchains are typically built around the decentralization principle. Decentralized blockchains have the advantage of being permissionless, trustless, and more secure due to their resistance to single points of failure. However, the massive energy consumption of leading cryptocurrencies such as Bitcoin and Ethereum, which use the Proof-of-Work consensus mechanism, has sparked widespread criticism. Proof-of-Work also has security and cost-effectiveness design issues. A Proof-of-Work blockchain is also more difficult to scale for a variety of reasons. To begin with, the number of transactions that a block can validate in a single block is limited. Second, blocks must be mined at a consistent rate.

This is referred to as the ‘scalability trilemma.’

The pre-merge Ethereum network was unable to meet the criteria for overcoming the scalability trilemma. Prior to the switch to PoS, a single Ethereum transaction consumed 200.05 kWh of electricity. It is nearly equal to the average US household’s electricity consumption in a week. With the Merge, Ethereum advances in addressing the classic scalability trilemma. It will also shift toward being more sustainable. Post-merge Ethereum will employ the Proof-of-Stake mechanism for increased security and code effectiveness. PoS is almost 2000x more energy efficient. It represents a reduction in total energy use of at least 99.95%. As Ethereum researcher Justin Drake stated, “The Merge will reduce worldwide electricity consumption by 0.2.”

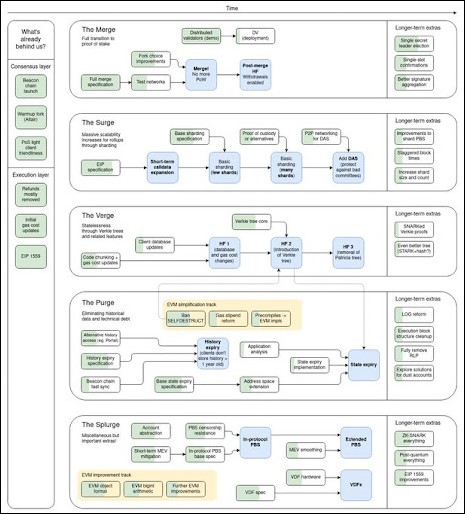

The most significant change in the Ethereum upgrade is the enormous reduction in power consumption. The second significant change brought about by the Ethereum Merge is the reduction of ETH issuance through rewards to validators for their work in maintaining the network. However, the transactional speed on the ETH network will not significantly increase. Previously, mining one block of ETH took about 13 seconds. This will be reduced to 12 seconds after the Merge. But as PoS means increased scalability, its impact on the developer community will be huge. The Ethereum upgrade does not completely resolve the scalability trilemma, but it does pave the way for ‘the Surge, the Verge, the Purge, and the Splurge.’ All of these efforts are intended to make Ethereum faster, safer, and more decentralized. The Merge marks 55% completion of Ethereum’s journey toward greater scalability and sustainability.

Mining rewards will no longer be distributed after the switch to PoS. As a result, annual ETH issuance will be reduced by approximately 90%. If the law of supply and demand holds true, the price of ETH will rise. While the long-term impact is difficult to predict, experts believe the Ethereum upgrade will cause prices to rise in the short term.

Following the Merge, Ethereum will become a PoS blockchain, with the PoW chain becoming obsolete. A difficulty bomb will reduce mining rewards, making chain mining unappealing. However, the Ethereum Merge is not expected to speed up the network or reduce transaction costs immediately. Investors are likely to see the benefits of the Ethereum Merge down the road.

While staking 32 ETH is necessary to become a validator on Ethereum’s Proof-of-Stake (PoS) network, anyone can run a non-validator, full node without this requirement. This includes syncing a self-verified copy of the Ethereum blockchain under both the Proof-of-Work (retired) and Proof-of-Stake consensus mechanisms. Running such nodes is vital for the network’s health and decentralization as it ensures a more robust and distributed network infrastructure.

Ethereum gas fees are calculated by network demand. It is directly related to network capacity. The Ethereum Merge phased out the use of Proof-of-Work in favor of Proof-of-Stake for consensus. But it made no significant changes to network capacity or throughput parameters. The Merge was a change in consensus mechanism and not in network capacity. So the Ethereum upgrade was never intended to lower gas fees.

You can determine the ‘speed’ of a transaction in a number of ways. These include the time it takes to be included in a block or the time it takes to get completed. Both of these changes are not noticeable to users. Proof-of-Stake introduced the previously unknown concept of transaction finality. So despite some minor changes due to the Ethereum upgrade, transaction speed on layer 1 is mostly the same as it was before the Merge.

The Merge does not yet support staking withdrawals. Staked ETH and staking rewards remain locked and inaccessible. Users are expected to withdraw stakes after the upcoming Shanghai upgrade.

Withdrawals will not be possible until the Shanghai upgrade. However, validators will have immediate access to the fee rewards or MEV (Miner Extractable Value) earned during block proposals—the protocol rewards validators with ETH for their contributions to consensus. Fee tips or MEV are credited to the validator’s non-staking account.

While the Shanghai upgrade does allow validators to withdraw their staking rewards and balances above 32 ETH, the base protocol includes mechanisms to prevent mass exits. Specifically, full validator exits are rate-limited; only six validators are allowed to exit per epoch. This rate limiting is crucial to ensure network stability and security, preventing sudden reductions in the number of active validators. Additionally, balances above 32 ETH do not accrue additional rewards, giving validators an incentive to manage their staked ETH efficiently.

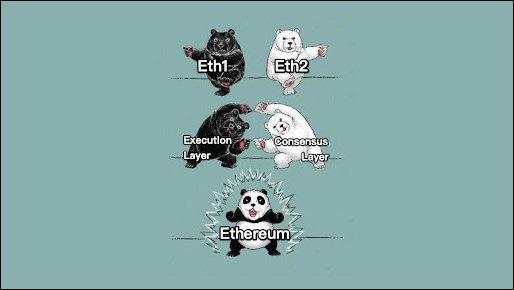

Previously, it was decided that after the Merge, the existing Proof-of-Work Ethereum chain (Eth1) would be deprecated via the difficulty bomb. Users and applications would migrate to Eth2, a new Proof-of-Stake Ethereum chain. ‘Eth1’ and ‘Eth2’, on the other hand, merged into a single chain after the Merge. As a result, distinguishing between two Ethereum networks is no longer necessary. And all references to ‘Eth1’ and ‘Eth2’ have been removed by the Ethereum Foundation.

The original Ethereum blockchain, formerly known as Eth1, has been rebranded as the ‘execution layer.’ This layer is responsible for handling transactions and executing smart contracts. Meanwhile, the newer Proof-of-Stake (PoS) chain, previously referred to as Eth2, is now called the ‘consensus layer.’ This layer is responsible for achieving network consensus and securing the blockchain. The renaming clarifies their distinct roles within the Ethereum ecosystem. As the Ethereum Foundation explained, “By removing Eth2 terminology, we save all future users from navigating this confusing mental model.”

The Ethereum upgrades include the Beacon Chain, the Merge, and the Surge, Verge, Purge, and Splurge. After all of the upgrades have been implemented, the new Ethereum blockchain is expected to be more scalable, secure, and long-lasting and yet maintain decentralization. The Ethereum upgrades are all interconnected in some way. Let’s have a look:

The splitting of a blockchain into smaller and more manageable segments is known as sharding. Ethereum’s sharding plans have shifted to determining the most efficient way to distribute the burden of storing compressed data from rollup contracts. It will allow for exponential network capacity growth. And to achieve this goal, it was inevitable first to implement the Proof-of-Stake mechanism. That is why the Merge occurred first, allowing for more efficient sharding.

The Ethereum Merge did not include certain anticipated features. These include the ability to withdraw staked ETH. It was done to simplify and maximize focus on a successful transition to Proof-of-Stake. The Shanghai upgrade is scheduled to address three critical Ethereum issues. It will allow modification of the Ethereum Virtual Machine (EVM) object format, enable stakers to withdraw from the Beacon Chain, and reduce the L2 fee.

Curious to know What Is Ethereum Shanghai Upgrade? Why is it Important? Go through the Ethereum Shanghai Upgrade article and get all the information that you want.👉

Although the Merge was a huge accomplishment, many more Ethereum blockchain upgrades are planned in the future. The flawless execution of the Merge represents a historic technical feat. Some have compared it to changing the engine of a rocket ship in mid-flight. As time passes, we can clearly see the Ethereum Merge and its impact on the crypto world. As Steven Goldfeder, co-founder and CEO of Offchain Labs, said, “One of the beauties of the Merge that we see is Ethereum has a long technical road map, but it’ll never be complete.”

Ethereum Merge has proven to be a pivot of unprecedented scale and complexity. The successful transition of Ethereum to a greener and more energy-efficient blockchain will lead to greater adoption of the technology in the long run. The switch to Proof-of-Stake is expected to reduce Ethereum’s energy consumption by 99.9%.

To prepare for the Merge, you will not need to do anything. Ethereum coin holders will not be required to do anything. During the Merge, you can simply leave your ETH in your personal wallets or on a personal exchange account. After the Ethereum upgrade, your ETH will be the new PoS-based Ethereum chain.

While the Merge had no significant impact on the price of ether, on-chain data showed a $1.2 billion inflow onto exchanges. In the short term, depending on the success and outcomes of the Merge, ETH prices may experience significant volatility. However, in the long run, this will strengthen Ethereum as a crypto asset.

Gas fees are the cost of carrying out an Ethereum transaction. Because the Merge has no effect on network capacity, users will not notice a change in this dynamic after the Merge is complete.

While no official announcement has been made regarding the other Ethereum upgrades, the Surge or Sharding upgrades are undoubtedly in the works. The first in the list – sharding – is scheduled to take place sometime in 2023.

Ethereum will increase scalability through sharding to increase throughput. However sharding on Ethereum is a feature that will be completed in the future that will potentially lower transaction costs and time. Sharding creates shard chains. These are like mini blockchains. However, they each contain a subset of blockchain data enabling more parallel transaction execution.

Switching to Proof-of-Stake will help Ethereum to transition to a more energy efficient consensus mechanism while distributing transactions across a larger and more diverse set of validators and users by lowering the required overhead for participation.

The “primary” distinction between Proof-of-Work (PoW) and Proof-of-Stake (PoS) lies in the roles and mechanisms used to secure the network. In PoW, miners use powerful computers to generate a hash that meets or falls below a target set by the network’s difficulty level. This process involves computing numerous hash values until a valid one is found that satisfies the condition, enabling the miner to add a new block to the blockchain. The first miner to solve the puzzle gains the right to add a new block to the blockchain, earning transaction fees and block rewards in return. This process requires significant computational power and energy.

On the other hand, PoS replaces miners with validators, who are chosen to create new blocks based on the amount of native cryptocurrency they hold and are willing to “stake” as collateral. Validators are selected to confirm transactions and create new blocks based on the size of their stake and other factors, such as the length of time they have held the stake. This method is considered more energy-efficient than PoW as it requires far less computational power.

Layer 1 Crypto Projects 2022 | What is Layer 1 Blockchain | What is a DDoS Attack | What are Soulbound Tokens | Best Blockchain Bridge | Blockchain Peer to Peer Payments | Pros and Cons of Blockchain | What are the Features of Blockchain | What is AMM in Crypto | Types of DAO | What is Blockchain Technology | What is Cloud Mining | How to Mint NFTS | How to Buy Land in Metaverse | Stack Mobile | What is Metaverse Crypto | What are Altcoins | Blockchain Infrastructure | NFT Use Cases 2022 | Blockchain Node Types