Wrapped Token in Crypto

Wrapped token is a digital asset representing another asset, typically on a different blockchain, enhancing interoperability. Read more about what is a wrapped...

Wrapped token is a digital asset representing another asset, typically on a different blockchain, enhancing interoperability. Read more about what is a wrapped...

The lack of interoperability among blockchains is something of a hurdle for the technology to solve next. Bitcoin and altcoins like ETH represent a value on their native blockchain, but can not be ported to other chains. The next step for these crypto-assets, therefore, is to facilitate usage over the non-native blockchain. This is where wrapped crypto comes in.

Wrapped tokens are essentially crypto assets that represent non-native crypto on a blockchain. In this post, let’s find out ‘what are wrapped tokens’ in detail, and also find out why wrapped tokens are popular among crypto traders right now!

Blockchain interoperability is the next step in the evolution of the technology. Bitcoin, Ethereum, and other crypto assets can be used on their native blockchains, but are of no use on other blockchain or DeFi platforms. However, as crypto traders, it’s not possible for you to acquire native tokens for every blockchain you need to access for various goods and services. This is an advantage wrapped tokens bring to blockchain: the ability to use crypto assets on non-native blockchains.

With wrapped tokens, a custodian freezes say a particular amount of BTC through the help of a smart contract and provides the user with the exact same amount in wBTC tokens. This means that the frozen crypto gets out of circulation, and instead, a wrapped asset is provided to the user by the custodian (keeper of the original asset). Such an asset can be easily used on any blockchain and still represents the same value as the underlying crypto. So, every wrapped token’s value is tethered to the original token in a 1:1 ratio.

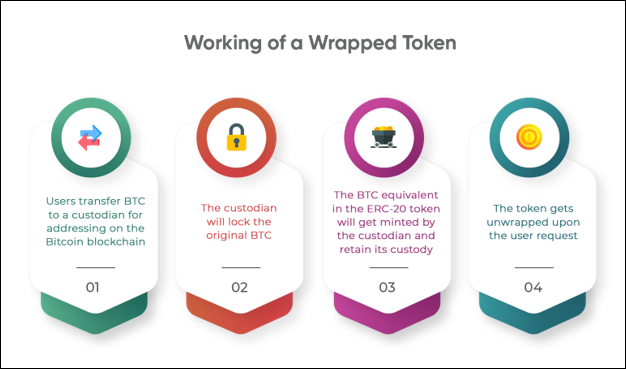

You have gotten a glimpse at what are wrapped tokens, and now you must understand how they work. The algorithm is simple, as it requires a smart contract and a set process to provide interoperability to any cryptocurrency. Wrapped tokens like wBTC are minted by the ‘custodians’ in charge. If you want to get a wrapped token for 1 ETH, for example, you will need to transfer the same amount in ETH to said custodian, who will first lock up your ETH in a vault. Then, they will ‘wrap’ the original asset, or mine a wETH.

If the users want their native token back, they transfer the wrapped asset after use to the custodian, who then burns the wrapped token in question and unlocks the original asset the user had locked up.

Wrapped tokens have become quite popular these days because of the functionality that they provide. Each cryptocurrency has its unique feature in the DeFi world. Ethereum offers a strong platform for DeFi applications, BTC turns out to be an excellent store of value, and similarly, other coins serve different, equally important purposes. Wrapped tokens provide an opportunity to access different functions of non-native blockchains to the user who does not own a variety of crypto assets.

Suppose a user who holds only BTC needs to use a DApp on Ethereum. Usually, they wouldn’t be able to do so due to the lack of interoperability between the two blockchains. However, wBTC would offer the user an opportunity to take advantage of DApps live on the ETH chain without holding any ETH themselves. So, in terms of usability, wrapped tokens provide great opportunities to the users while promoting interoperability.

Wrapped crypto has its fair share of pros and cons. As a smart user, you should be in the loop with both these aspects since it will help you use them to your advantage.

While learning about what is a wrapped token, you will also need to understand the limitations it faces. One of the major limitations is related to the minting of wrapped tokens. Firstly, there is a requirement for centralized institutions that will freeze native tokens in a vault and mint a wrapped token to put into circulation. So, as a user, you have to rely on a third party to use wrapped crypto.

Due to centralization, some currencies may become vulnerable to unjust usage, which raises security concerns for the wrapped crypto buyers. The requirement of a custodian and paying a transaction fee to them defeats the purpose of decentralization and puts wrapped crypto in a bad spot. As a user, you should be aware of all these limitations before using wrapped tokens yourself.

Ethereum provides an intuitive platform for DeFi applications, while altcoins like Cardano support democratization and technological advancement for a fairer DeFi society. Imagine being able to interoperate all these features using one crypto asset. This is what wrapped tokens are used for.

Suppose you have only BTC, but want to create a DeFi application (DApp) on Ethereum. You cannot do so directly, but with wBTC, you can take your BTC to the ETH chain in wrapped crypto form and create your DeFi application. Meanwhile, the price yield from BTC is still a viable option for you since you can exchange the wBTC for your BTC without any transaction cost through the custodian.

So, wrapped tokens primarily serve interoperability purposes, while still allowing you to put your original assets to work should you choose to do so.

Wrapped tokens represent a similar value as the native token, and if the price of the native token rises, the same goes for the wrapped crypto. This is why wrapped assets are gaining popularity and seem to have a brighter future. Developers are working on creating a model that allows users to become custodians. This will help cut usage costs and support security protocol for the wrapped tokens.

With the rise in prices of crypto assets, wrapped crypto also brings an opportunity to earn great profits while jumping between blockchains. So, investing in wrapped tokens can be beneficial in the future because of their rising popularity, and their excellent, diverse usability.

While speaking of the interoperability among blockchains wrapped crypto brings, we also need to talk about whether wrapped tokens are safe or not. As many analysts have raised concerns, the crypto community is still at large to find out if wrapped crypto is truly secure. After all, crypto assets issued through smart contracts provided by the custodians cannot be completely trusted. This leads to a centralization of the assets and putting an unfair amount of power into the hands of the custodians.

Wrapped tokens also pose a security concern in terms of users being unable to get their original tokens back due to issues with the smart contracts. Such cases are rather fewer in number but do pose a threat. However, with technological advancements, the crypto community can rest assured that all such safety concerns regarding wrapped tokens will be addressed. What’s more, in the future, wrapped crypto might also provide further opportunities to stake crypto over a non-native blockchain.

Some decentralized smart contract-based bridges even provide wrapped crypto without any central authority to control the transaction. Such contact bridges provide safety options to the users, thus promoting wrapped crypto.

Currently, wrapped tokens are regarded as relatively safe and a great investment option. With the constant developments in the crypto community, the gap between blockchains will reduce even more with wrapped tokens. As a newcomer investing in wrapped crypto, the best option might be to stick with the more popular ones like wBTC and wETH, however.

DeFi has been facing problems relating to interoperability, and the current movement to speed up the Ethereum chain’s DeFi movement has led to further demands for cross-chain interaction. Wrapped tokens serve as a bridge between various blockchains and thus serve the DeFi movement perfectly. In fact, wrapped crypto offers a chance to bring DeFi closer together and thus brings financial freedom from central authorities. Rising above the need for a custodian or any other solution will be the final step to building an interoperable blockchain network.

Many wrapped tokens are now available for users to enjoy interoperability over DeFi networks. Users can now operate BTC over ETH’s smart contracts using wrapped crypto. As an investor, you can stake various assets over wrapped crypto and provide higher liquidity to DeFi networks. On the other hand, wrapped tokens allow the blockchain to attract digital assets from another blockchain. DeFi applications interact with various wrapped crypto and provide a chance at increased liquidity. So, wrapped tokens are overall improving liquidity in the DeFi ecosystem.

Within the DeFi ecosystem, wrapped crypto allows users to interact with different blockchains using one asset. As you purchase wrapped crypto, you can jump between blockchains as the custodian mints ERC-20 tokens for you to move to a blockchain you want to make use of for a particular functionality. Therefore, jumping across blockchains is a possibility opened up by wrapped tokens.

Since we have already discussed custodians, you know that they mint-wrapped crypto. All you have to do is transfer some of your tokens to them to get wrapped tokens in exchange.

The users can also go to crypto exchange platforms like Uniswap to purchase wrapped tokens in exchange for their native tokens. Private custodians, of course, also directly wrap the native token and provide a wrapped token on the chain you want to operate on. Some users also use DeFi contact bridges to get wrapped tokens.

Wrapping tokens means the users freeze away their assets in a secured vault and create an ERC-20 token representing a similar value. This is done through a custodian, and the frozen tokens are stored in the vaults until the user wishes to exchange them. When you learn about what is a wrapped token, you learn that the frozen tokens are put out of circulation, and the wrapped tokens created to represent them need to be burnt for them to be brought back into circulation.

As discussed, wrapped tokens are not actual tokens covered in some protective layer. They are representative assets made using smart contracts on the blockchain that their users want to operate on. They provide interoperability between various blockchains and allow users to enjoy the functionalities of a wide variety of blockchains.

DeFi networks have been facing challenges relating to interoperability for a long time. There needs to be a change so multiple blockchains can cooperate without making the users purchase multiple assets. Wrapped tokens can provide great support in this area and add interoperability to blockchain.

With all the discussion above, you must understand what is a wrapped token and how it is beneficial for the current blockchain and crypto scenario. It offers a chance to use one token over multiple chains instead of having to go to the inconvenience of holding different tokens for different blockchains. So, it can be concluded that the wrapped tokens are a great advancement in blockchain technology.

How to Make and Sell NFT | Peer to Peer Money Transfer | Blockchain Transaction | Advantages and Disadvantages of Blockchain Technology | What are Layer 1 Blockchain | Main Features of Blockchain | How Does Blockchain Wallet Work | How to Buy Real Estate in the Metaverse | What is Proof of Work in Blockchain | Blockchain Advantages | Whales in Crypto | Staking Coins | Types of Nodes in Blockchain | What are Ethereum Virtual Machines | Fiat Money Advantages | What is the Purpose of Nonce in Blockchain | Ethereum Merge Importance | Physical Layer in OSI Model | What are the Types of Decentralization